July 6, 2021

Written by Rupert Sheldon, Head of Core REIM, UK

The principles of core real estate investing are simple: lease your property, collect your rents, watch the rent grow over time and enjoy capital appreciation where market conditions permit. At the end of the lease term, be ready to refurbish the property and lease it up again.

So far so good, but what goes up can also go down and real estate is, by definition, a depreciating asset and particularly so as you get closer to the end of the lease. It therefore follows that to out-perform consistently over time an investor must not only collect and grow rents but also minimise the impact of depreciation over the longer term, either by owning assets with longer unexpired lease terms or through active management, or preferably, a combination of the two.

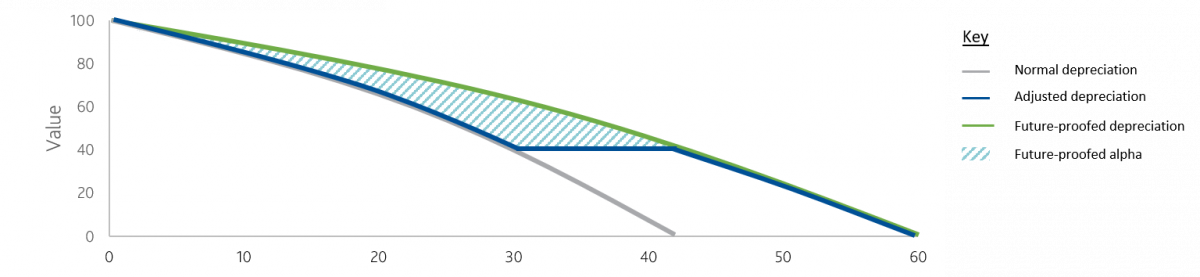

Depreciation, or obsolescence in commercial real estate takes many forms. The following graph illustrates the behaviour of an office asset over its useful economic life with the grey line indicating typical depreciation from new build to functional obsolescence beyond which redevelopment or re-purposing is the only option. The key to sustained capital value out-performance therefore comes from being able to flatten the depreciation curve during your ownership, often by extending a building’s economic life or “future proofing”. If successful, this can serve to generate alpha as illustrated by the green line below therefore saving the need for costly capital investment in order to plug this performance gap as per the blue line. Whilst the graph is somewhat simplistic the principles hold true for all commercial real estate assets.

Figure 1: The Depreciation Curve

What is Obsolescence in Commercial Real Estate?

Obsolescence or depreciation varies from one asset class to another. These different types of obsolescence can also change through economic and market cycles and are explored in more detail below:

- Structural obsolescence – High Street or “in-town” retail, whether a single unit or shopping centre, has witnessed unprecedented levels of structural obsolescence over the past 10 years. The rise in internet sales has reduced the need for physical retail rendering large swathes of the high street structurally obsolete and in need of physical re-purposing. These same factors have driven increasing demand for logistics and distribution units whilst a potential change in post Covid-19 working practices have left some secondary office assets at risk from widespread structural obsolescence.

At Fiera Real Estate we have positioned our portfolios with minimal exposure to at risk retail and office assets and an overweight position to industrial and logistics with a view to defending against this risk.

- Technological Obsolescence – Older assets can become stranded from a technological point of view. An older office building may continue to provide a degree of functionality to today’s occupier but compromised floor to ceiling heights, a lack of servicing void in either the floor or ceiling (for cabling) and an absence of infrastructure to support modern technology will serve to undermine overall occupier appeal. To re-lease the property may prove very expensive. Conversely a new build technologically enabled or “Smart” building will serve to meet current and future occupier requirements offering adaptability and flexibility over time as technology progresses. “Halo” in Bristol is currently under construction and represents a great example of a best in class, technologically enabled asset, future proofed to beat the depreciation curve.

BREEAM Outstanding Halo is currently being developed by Cubex Land and funded by Fiera Real Estate’s Opportunity Fund IV UK

- ESG obsolescence – ESG or Environmental, Social & Governance has leapt to the top of the agenda in recent years and particularly so since the start of the global Covid-19 pandemic in Q1 2020. The effects of a changing climate may render the location of assets unsuitable for occupation, whilst a focus on employee wellbeing may make certain assets harder to re-lease.

At Fiera Real Estate, we have developed an ESG resilience scorecard within our proprietary Asset Risk Scoring model. This enables each asset to be measured on a quarterly basis against the portfolio and wider market by scoring areas such as flood risk, climate change risk, BREEAM or EPC accreditations and type and intensity of energy usage.

The speed of change in this key area is difficult to overstate. Failure to embrace and adapt will likely have dire consequences resulting in discounted pricing on sale at best and outright asset illiquidity at worst. For many older assets the only way to protect against a steepening depreciation curve will be to commit further investment capital in order to future proof – for some this may not be economically viable.

At Fiera Real Estate we have a track record of bringing our own development partners, Fiera Real Estate Funds and end occupiers together in an ESG “virtuous circle” to ensure that all key stakeholders are able to achieve their longer term ESG goals through early engagement in building design and specification. This is illustrated in the example below where the Fiera Real Estate Long Income Fund UK is currently financing the construction, by Opus Land, of a BREEAM “Excellent”, EPC “A” ESG exemplar asset, pre-let to Cadent Gas Limited for 20 years with five yearly RPI linked rent reviews. The future proofing of this asset should ensure depreciation “Alpha” as per the green line in Figure 1 above and therefore capital value out-performance over the longer term.

Forward Funding of ESG exemplar pre-let office building by Fiera Real Estate Long Income Fund UK

The depreciation risks identified above are just some of the risks an investor faces when seeking to defend capital values and drive performance across invested portfolios. Longer leases to financially strong companies on fully repairing leases provides the simplest solution.

However, even for the most disciplined and organised investor, each of these key risks remain. If they can be effectively managed, then they can be transformed into opportunities for out-performance over the wider market. Conversely, for those who fail to embrace change or are invested in the wrong areas of the market, the future looks bleak.

Flattening the depreciation curve will remain a key investment objective for all Fiera Real Estate managed funds and separate accounts as we seek depreciation “alpha” over the longer term and continued out-performance for our investors.

Click here to read our latest whitepaper on The Appeal of UK Core Long-Income Investing.

Click here to read more about the Fiera Real Estate Long Income Fund (“FRELIF”)